Whoa! So I was poking around some DeFi protocols on Solana the other day and realized how wild this space has become. You’ve got all these yield farming opportunities popping up like mushrooms after a rainstorm—each promising crazy returns but layered with risks that are sometimes barely visible at first glance. Honestly, my first impression was that this is a gold rush, but then I started thinking deeper about how you even keep track of your assets when they’re scattered across farms, staking pools, and various liquidity vaults.

Here’s the thing. Yield farming isn’t just about chasing the highest APY anymore. It’s also about managing your portfolio smartly so you don’t lose your shirt. On Solana, this gets even trickier because transactions are blazing fast and cheap, which feels great, but it means you might be jumping into a dozen protocols before you even realize how fragmented your holdings are. This fragmentation can lead to missed opportunities or worse—funds stuck in abandoned farms.

At first, I thought, “Okay, just use one of those portfolio trackers and call it a day.” But wait—many trackers out there don’t fully support Solana’s ecosystem nuances, or they lag behind new protocol launches. So, you might think you’ve harvested all your rewards, but the tracker says otherwise, or worse, it doesn’t even show some tokens you’ve staked. Ugh, that bugs me.

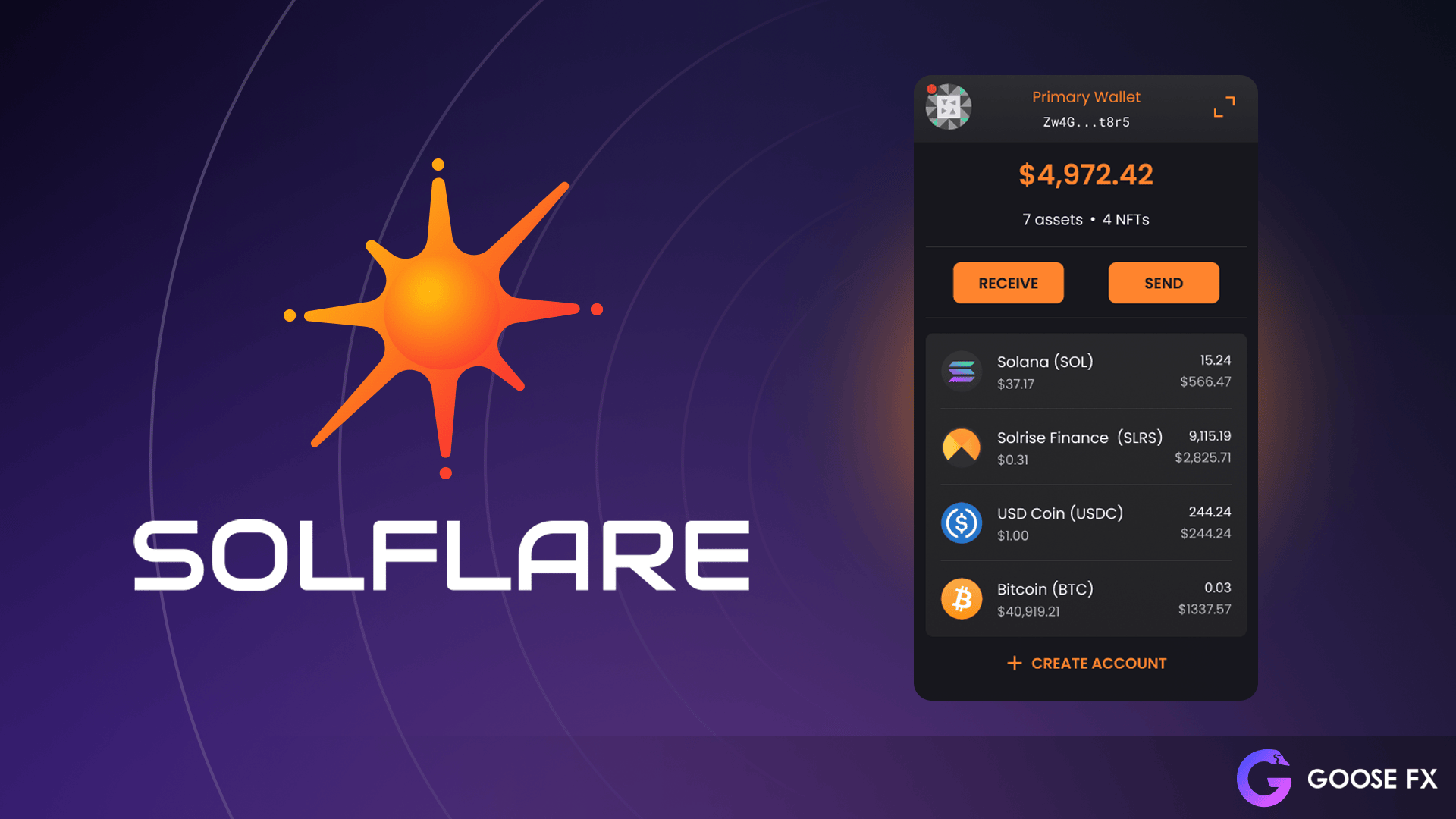

Something felt off about the whole experience until I stumbled upon tools that integrate tightly with wallets designed for Solana’s DeFi landscape. Personally, I’ve been using solflare for a while now, and it’s a game changer. Not just because it’s a wallet, but because it syncs seamlessly with staking protocols and yield farms, offering a consolidated view that’s hard to beat. Seriously, it saves me from juggling five different apps just to check my positions.

But there’s more to it. Yield farming on Solana often involves complex strategies: you’d stake your SOL in one protocol to earn tokens, then use those tokens in another farm, and maybe even borrow against them elsewhere. It’s a tangled web, and your portfolio can look like a jigsaw puzzle with pieces scattered everywhere. That’s why good portfolio tracking isn’t optional—it’s a necessity. Without it, you’re flying blind, and in crypto, flying blind rarely ends well.

Why Yield Farming on Solana Feels Different

Okay, so check this out—Solana’s speed and low fees make yield farming actually enjoyable compared to Ethereum’s gas fee headaches. But that same speed means you can open positions rapidly, which is a double-edged sword. You might jump into farms without thorough due diligence, chasing shiny new tokens, and before you know it, your portfolio is a mess of locked assets across protocols you barely remember. I’m biased, but I think this is where a wallet like solflare shines. It helps keep your DeFi activities somewhat streamlined, so you’re not constantly losing track.

Initially, I thought all yield farms were pretty much the same—stake tokens, earn rewards, rinse and repeat. But then I realized that each protocol has its own quirks. Some offer auto-compounding, others require manual claiming, and a few even have lock-up periods that can seriously hamper your liquidity. On one hand, some farms are super flexible, but actually, many come with hidden catchphrases buried in their fine print that can trip you up if you’re not paying attention.

And let me tell you, not all yield farming is created equal. Some protocols are downright sketchy—rug pulls, poorly audited smart contracts, and incentive structures designed to drain your wallet faster than you can say “DeFi disaster.” So, yield farming is not just about farming yields; it’s about farming them smartly and securely, which brings us back to the importance of using a wallet and portfolio tracker that you can trust.

One thing that often gets overlooked is how tax implications can spiral out of control when you’re hopping between farms and protocols. Each claim or swap can be a taxable event, and keeping a detailed ledger is a nightmare without proper tools. This is especially true here in the US, where the IRS has been cracking down on crypto reporting. So yeah, a reliable tracker isn’t just about convenience; it might save you from a very unpleasant surprise come tax season.

Portfolio Tracking: The Unsung Hero

I’ll be honest—portfolio tracking sometimes feels like the boring side of DeFi, but it’s actually very very important. Without it, you can’t really gauge your true performance or risk exposure. Plus, it’s easy to overlook rewards sitting unclaimed, which is literally free money slipping through your fingers. It drives me nuts when I see folks miss out on these because they didn’t have an integrated view.

What’s cool about Solana-focused tools is their ability to pull data directly from the blockchain and various protocols in near real-time. That means you get an accurate snapshot without waiting hours or days. Also, wallets like solflare often include native support for staking and DeFi protocols, reducing the friction between managing assets and keeping an eye on yield farming performance.

Still, no tool is perfect. Some trackers might not support brand new tokens or farms right away, and sometimes the UI can be overwhelming for newcomers. I’m not 100% sure if the user experience will ever be truly seamless because the ecosystem itself is evolving so fast. But the direction is promising. The best approach might be to combine the right wallet with selective use of third-party trackers, depending on your strategy.

Oh, and by the way, I’ve noticed that some of my friends who jumped headfirst into DeFi without proper tracking ended up with fragmented portfolios that were a pain to consolidate later. So even if you’re just starting, thinking about portfolio visibility now can save headaches down the road.

Final Thoughts: Navigating DeFi’s Growing Complexity

So, circling back—what’s the takeaway here? DeFi yield farming on Solana is exhilarating but can quickly become a chaotic juggling act. My gut feeling says that success in this space isn’t just about high APYs but having the right tools to manage, track, and secure your assets. I’m still learning, honestly, and I make mistakes too, but having a solid wallet like solflare that integrates portfolio tracking and staking capabilities has made a world of difference for me.

There’s a lot of potential here, but also a fair share of pitfalls. So if you’re diving into Solana’s DeFi world, don’t just chase yields blindly. Take a beat. Use a good wallet. Track your portfolio regularly. And remember, sometimes the best yield is the one you actually get to keep.